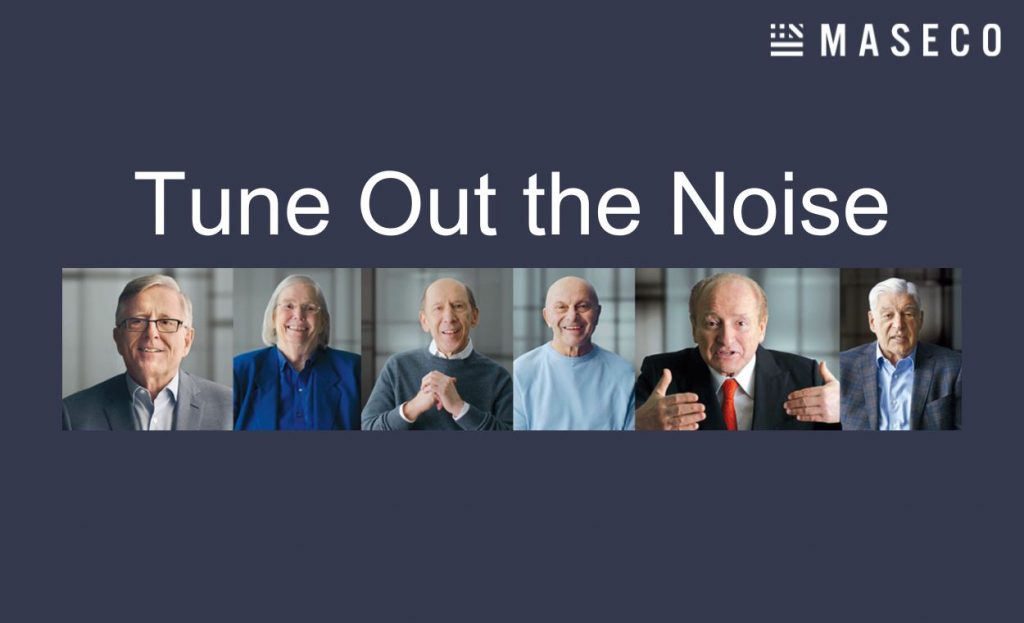

Tune Out the Noise Screening Event

On Tuesday 16th April, MASECO Asia, in conjunction with Dimensional Fund Advisors, hosted an exclusive viewing of the documentary Tune Out the Noise, a film directed by Academy Award-winner Errol Morris, featuring Nobel laureates including Eugene Fama and Robert Merton. This feature film tells the story of how a group of innovators at the University of …